ESG Questionnaire for Legal Entities. Why do we need ESG data?

Why do we fill out the ESG questionnaire?

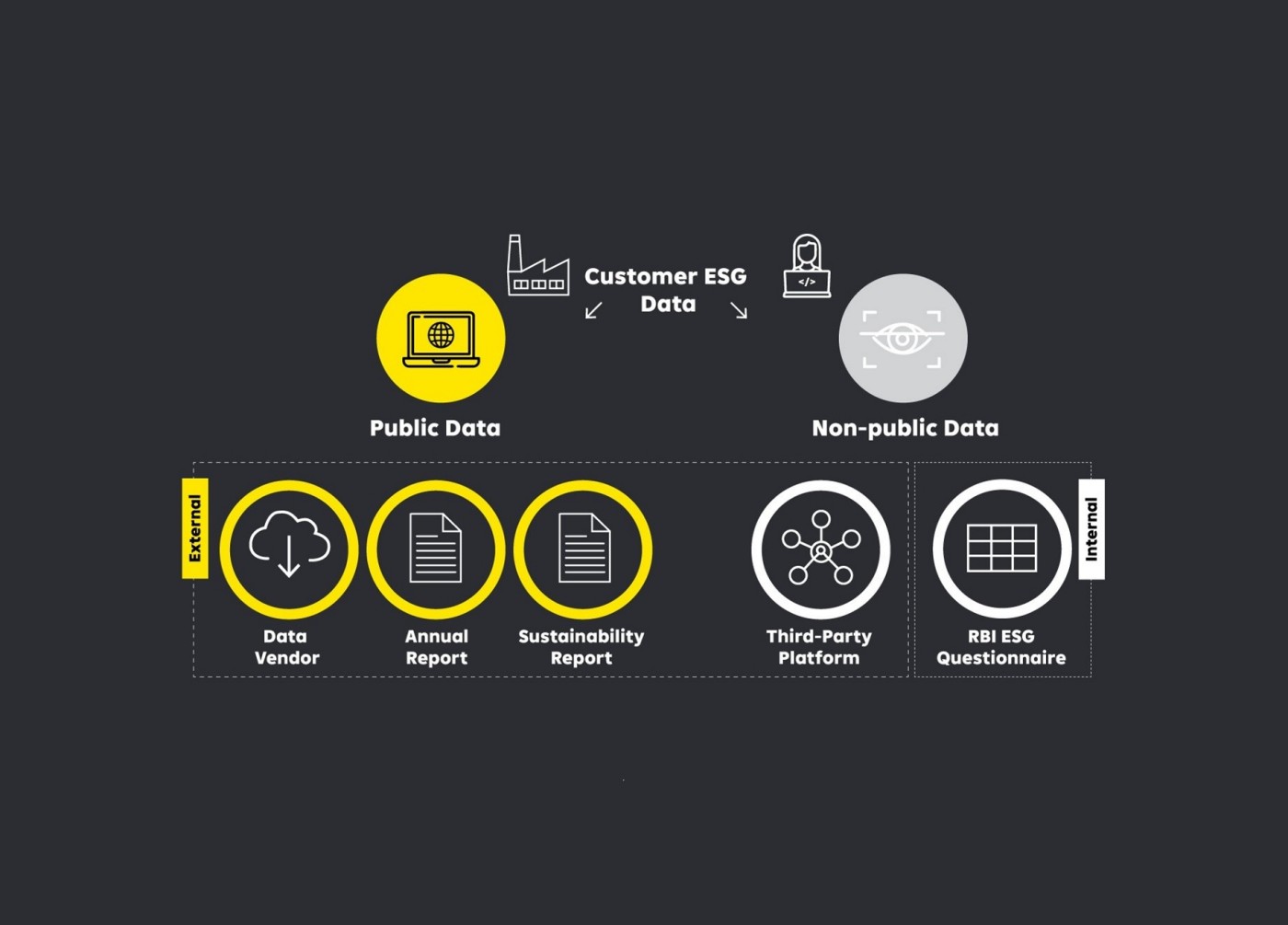

- Environmental, social, and governance (ESG) aspects are playing an increasingly important role in the business world, and reporting based on ESG data is becoming the foundation for monitoring the transition to a sustainable economy. To meet the ESG regulatory requirements at the European Union level and support climate-related risk management, we have developed a questionnaire that allows us to collect relevant environmental information directly from our business clients. Raiffeisen Bank strives to make the data collection process as easy and convenient as possible for each client. ESG data collection is conducted through publicly available data and direct data collected from clients, as shown below.

- Why is it necessary to provide ESG data if the official ESG EU regulations (e.g., Non-Financial Reporting Directive) are not yet implemented in our country?

- In addition to the importance of collecting this data for your business, by providing ESG data through this questionnaire, Raiffeisen Bank will:

- - Better understand your ESG strategy and activities,- Support your company in the transformation process towards a green agenda,- Be able to adequately assess your ESG risks and offer appropriate financial services.

How to fill out the ESG questionnaire - Video guide

Companies play a key role in mitigating climate change and consequently preserving the entire environment. To measure each company's contribution, data is collected through the ESG questionnaire. Watch the video that will explain and guide you through this process.

How ESG data can benefit us

- Investors analyze ESG data to assess the sustainability of investments and make responsible decisions. This data can include CO2 emissions, water consumption, and inclusive initiatives. Collecting data is the first step in measuring a company's ESG performance and can be used to create standards, compare companies, and track progress.

- Companies need to clearly understand the collected data, collection methods, and their accuracy.

- Collecting ESG data can be challenging and requires effort, but it brings numerous benefits:

- - Precise financing conditions- Broader investor base- Better comparability with competitors/your industry- Improved management of climate risks- Enhanced reputation

What elements are included in the ESG questionnaire?

General Questions

- Industry – main industry of your company's activity (according to GCIS)-

- Reporting year

- Production / added value

- Process emissions

- Carbon emissions / greenhouse effect (scope 1, 2, and 3)

- Energy consumption

- Emission intensity

- EU Taxonomy

- Circular economy (waste management)

- Water consumption- Instruments for sustainable financing

- Financial instruments related to ESG

Feedback

Frequently Asked Questions about Filling Out the ESG Questionnaire

Environmental, social, and governance (ESG) aspects will play an increasingly important role in the financial system. Reporting based on accurate ESG data will be one of the foundations for monitoring the transition to a more sustainable economy. For this, we need your support to provide us with your ESG data in a structured format.

Yes, and there are several reasons why you will benefit from this process. Although we, as a bank based in Europe, are obligated to meet ESG regulatory requirements under the EU Green Deal, the advantages you gain from this process are:

- We better understand your strategy and activities.

- The ESG team within the Bank can support you in the transformation process.

- The Bank will conduct a fairer assessment of your ESG risks.

- This will help you benefit from preferential financing, and we will be able to offer you more tailored financial services.

Yes, we strive to gather as much ESG data as possible from already published sources—including data related to the "social" and "governance" aspects of sustainability from your Sustainability Report. However, we need to ask you additional questions regarding the "environmental" aspect.

Raiffeisen Bank will use your data for three reasons:

1. Calculating an internal ESG assessment that will be used in credit decision-making.

2. Providing support in the transformation process towards a green agenda.

3. ESG data reporting in aggregate format to regulators and supervisors.

We understand that it might be challenging to gather all the requested ESG data. If you lack certain ESG data, we are available to provide any additional explanations and assistance in completing the questionnaire.

You need to choose whether to enter consolidated or standalone data. Standalone data is preferred as it allows for more precise reporting. However, if data is only available at the consolidated group level—such as greenhouse gas (GHG) emissions data—then consolidated group data will be collected. IMPORTANT INFORMATION: Please enter either standalone or consolidated data, but do not change the reporting structure between questions!

Once a year, for which you will receive a special notification from the Bank.

Gray fields are either inactive or will be filled out by the bank—you do not need to complete these fields.

On the "Glossary" page of the questionnaire, you can find useful definitions and web links to relevant regulatory frameworks.

On the "Industries Clustering" page of the questionnaire, you can find the division of industries based on the Global Industry Classification System (GICS).

Comprehensive support material is available within the ESG questionnaire: explanations and examples are provided next to each question; definitions can be found on the "Glossary" page; a unit conversion tool is in the "Convertor" section; an overview of different emission types is in the "Emission Types" section; the table of GICS codes for determining your main industry is in the "Industry Clustering" section.

If you have questions or need further clarification, we are available to assist you. You can send your inquiries to the following email addresses:

esgsteering@raiffeisengroup.ba and elvir.cobo@raiffeisengroup.ba